See our updated version of this article that was posted on our blog on April 6.

https://larssonwoodyardhenson.blogspot.com/2020/04/updated-04-03-20-family-first-and-cares.html

Note that all of the information summarized below is current as of March 28, 2020 and is based off of the resources that were available at that time. There may be changes as more guidance is released.

https://larssonwoodyardhenson.blogspot.com/2020/04/updated-04-03-20-family-first-and-cares.html

Note that all of the information summarized below is current as of March 28, 2020 and is based off of the resources that were available at that time. There may be changes as more guidance is released.

Please contact us for further explanation

and to discuss how these new acts will impact you.

Family

First Coronavirus Response Act

Effective

Beginning April 1, 2020

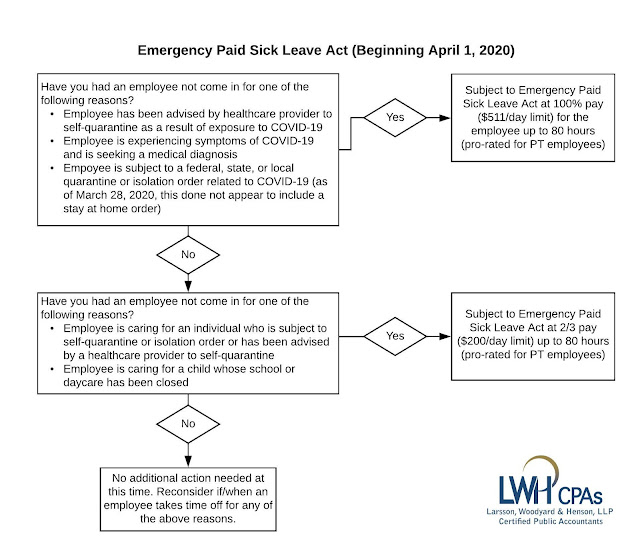

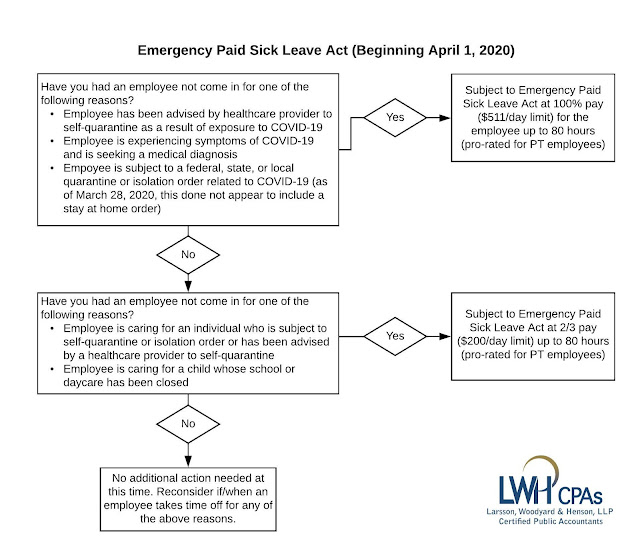

1. Emergency Paid Sick Leave Act

The Act requires up to two weeks

of paid sick leave to all employees of employers with fewer than 500

employees. The Act covers both full-time and part-time employees, although

part-time employees may not be entitled to a full two weeks of paid

leave. Part-time employees are entitled to paid leave equal to the number

of hours they work on average over a two-week period.

Paid leave is

triggered by one of the following reasons:

·

An employee is subject to a federal, state or local quarantine

order related to COVID-19. (Businesses that are considered non-essential by the Governor’s

stay-at-home order currently do not appear to be included in this even if the

business remains open but employees are told not to work solely because of the

stay-at-home order.)

·

An employee has been advised by a healthcare provider to

self-quarantine as a result of exposure to COVID-19.

·

An employee is experiencing symptoms of COVID-19 and is seeking

a medical diagnosis.

·

An employee is caring for an individual who is subject to a

self-quarantine or isolation order or has been advised by a healthcare provider

to self-quarantine.

·

An employee is caring for a child whose school (or daycare) has

been closed.

·

An employee has any other qualifying condition under rules to be

set forth by the Secretary of the Treasury or the Secretary of Labor.

Notes: Hourly employees with

fluctuating schedules will receive the equivalent pay for the average hours

they would work per day over the prior 6-month period.

Wages paid under the Sick Leave and

Expansion Act are subject to Medicare Tax but not Social Security Tax.

2. Emergency Family and Medical Leave Expansion Act

The Act provides up to 12 weeks of Family and Medical Leave

if an employee is unable to work because the school or day care facility for a

child under the age of 18 has been closed or the child’s babysitter or nanny is

unable to work as a result of a COVID-19 emergency declared by the federal,

state or local government. In order to be eligible, an employee must have

worked for at least 30 days for the employer. In addition, the first 10

days of leave may be unpaid, however, they could be eligible for the two weeks

of paid leave under the Sick Leave Act. The Act simply adds another reason

an employee may take Family and Medical Leave. It does not increase the

amount of leave available to an employee beyond what is already available under

current law. Employers with

fewer than 50 employees are eligible for an exemption from the requirements to

provide leave to care for a child whose school is closed, or child care is

unavailable in cases where the viability of the business is threatened. The exemption will be available

on the basis of simple and clear criteria that make it available in

circumstances involving jeopardy to the viability of an employer's business as

a going concern. Labor will provide emergency guidance and rulemaking to

clearly articulate this standard.

3. Employer Reimbursement

Employers receive 100%

reimbursement for paid leave pursuant to the Act. This is accomplished by retaining the payroll

tax deposit that would otherwise be required to be remitted to the IRS. If the payroll tax deposit is insufficient to

cover the paid leave, the employer will be able to file a request for an

accelerated payment from the IRS.

(Procedure not yet available.)

Any credit received under this

Act will be considered income to the employer for income tax purposes.

Paid Sick Leave Credit

For an employee who is unable to

work because of Coronavirus quarantine or self-quarantine or has Coronavirus

symptoms and is seeking a medical diagnosis, eligible employers may receive a

refundable sick leave credit for sick leave at the employee's regular rate of

pay, up to $511 per day and $5,110 in the aggregate, for a total of 10 days.

For an employee who is caring for

someone with Coronavirus, or is caring for a child because the child's school

or child care facility is closed, or the child care provider is unavailable due

to the Coronavirus, eligible employers may claim a credit for two-thirds of the

employee's regular rate of pay, up to $200 per day and $2,000 in the aggregate,

for up to 10 days.

Child Care Leave Credit

In addition to the sick leave

credit, for an employee who is unable to work because of a need to care for a

child whose school or child care facility is closed or whose child care provider

is unavailable due to the Coronavirus, eligible employers may receive a

refundable child care leave credit. This credit is equal to two-thirds of the

employee's regular pay, capped at $200 per day or $10,000 in the aggregate. Up

to 10 weeks of qualifying leave can be counted towards the child care leave

credit.

Notes: Both credits are increased by

the Employer Medicare Tax. Eligible

employers are also entitled to an additional tax credit determined based on

costs to maintain health insurance coverage for the eligible employee during

the leave period.

Prompt Payment for the Cost of

Providing Leave

When employers pay their

employees, they are required to withhold from their employees' paychecks

federal income taxes and the employees' share of Social Security and Medicare

taxes. The employers then are required to deposit these federal taxes, along with

their share of Social Security and Medicare taxes, with the IRS and file

quarterly payroll tax returns (Form 941 series) with

the IRS.

Under guidance that will

be released soon, eligible employers who pay qualifying sick or child care

leave will be able to retain an amount of the payroll taxes equal to the amount

of qualifying sick and child care leave that they paid, rather than deposit them

with the IRS.

The payroll taxes that are

available for retention include withheld federal income taxes, the employee

share of Social Security and Medicare taxes, and the employer share of Social

Security and Medicare taxes with respect to all employees.

If there are not

sufficient payroll taxes to cover the cost of qualified sick and child care

leave paid, employers will be able file a request for an accelerated payment

from the IRS. The IRS expects to process these requests in two weeks or less.

The details of this new, expedited procedure will be provided by the IRS.

4.

Non-Enforcement Period

Labor will be issuing a

temporary non-enforcement policy that provides a period of time for employers

to come into compliance with the Act. Under this policy, Labor will not bring

an enforcement action against any employer for violations of the Act so long as

the employer has acted reasonably and in good faith to comply with the Act.

Labor will instead focus on compliance assistance during the 30-day period, which

begins April 1.

Coronavirus Aid, Relief, and Economic Security Act CARES Act passed March 27, 2020

Refundable payroll tax credit for 50%

of wages paid by eligible employers to certain employees during the COVID-19

crisis.

Eligible employers. The credit is available to employers,

including non-profits, whose operations have been fully or partially suspended

as a result of a government order limiting commerce, travel, or group meetings.

Employers must have experienced a greater than 50% reduction in quarterly

receipts, measured on a year-over-year basis.

The credit is not available to employers

receiving Small Business Interruption Loans under Sec. 1102 of the Act.

Wages paid to which employees? For employers who had an average number

of full-time employees in 2019 of 100 or fewer, all employee wages are

eligible, regardless of whether the employee is furloughed. For employers who

had a larger average number of full-time employees in 2019, only the wages of

employees who are furloughed or face reduced hours as a result of their

employers' closure or reduced gross receipts are eligible for the credit.

No credit is available with respect to

an employee for any period for which the employer is allowed a Work Opportunity

Credit with respect to the employee.

Wages. The term "wages" includes

health benefits and is capped at the first $10,000 in wages paid by the

employer to an eligible employee.

Wages do not include amounts taken into

account for purposes of the payroll credits, for required paid sick leave or

required paid family leave in the Families First Coronavirus Act, nor for wages

taken into account for the employer credit for paid family and medical leave.

Other. IRS is granted authority to advance

payments to eligible employers and to waive applicable penalties for employers

who do not deposit applicable payroll taxes in anticipation of receiving the

credit.

Effective date. The credit applies to wages paid after

March 12, 2020 and before Jan. 1, 2021.

Delay

of payment of employer payroll taxes

The CARES Act allows taxpayers to defer

paying the employer portion of certain payroll taxes through the end of 2020. The

delay of payroll tax deposits requires 50% of certain payroll taxes to be paid

by December 31, 2021, with the remaining 50% due by December 31, 2022. This

rule won't apply to any taxpayer which has had indebtedness forgiven under the

loan programs.

Net Operating Loss rule changes

The

CARES Act temporarily removes the taxable income limitation to allow an NOL to

fully offset income. NOLs

arising in a tax year beginning after Dec. 31, 2018 and before Jan. 1, 2021 can

be carried back to each of the five tax years preceding the tax year of such

loss.

Effective

date. The amendments apply to tax years

beginning after Dec. 31, 2017, and to tax years beginning on or before Dec. 31,

2017, to which NOLs arising in tax years beginning after Dec. 31, 2017 are

carried.

Modification of limitation on losses

for noncorporate taxpayers

Noncorporate taxpayers can deduct excess

business losses (over $250,000) arising in 2018, 2019, and 2020.

Limit on interest expense

The CARES Act temporarily and

retroactively increases the limitation on the deductibility of interest expense

under Code Sec. 163(j)(1) from 30% to 50%

for tax years beginning in 2019 and 2020.

Under a special rule for partnerships, the increase in the limitation

will not apply to partners in partnerships for 2019 (it applies only in 2020).

Qualified Improvement Property now

eligible for bonus depreciation

The CARES Act provides a technical

correction and specifically designates “qualified improvement property” as

15-year property for depreciation purposes. This makes QI Property a category

eligible for 100% Bonus Depreciation.

Effective for property placed in service after Dec. 31, 2017.

Individual recovery rebate/advanced

2020 tax credit

Most individuals are allowed an income

tax credit for 2020 equal to the sum of: (1) $1,200 ($2,400 for eligible

individuals filing a joint return) plus (2) $500 for each qualifying child. The credit is being paid out in advance. The amount of the credit is reduced by 5% of

the taxpayer's adjusted gross income (AGI) in excess of: (1) $150,000 for a

joint return, (2) $112,500 for a head of household, and (3) $75,000 for all

other taxpayers. Under these rules, the

credit is completely phased-out for a single filer with AGI exceeding $99,000

and for joint filers with no children with AGI exceeding $198,000. For a head

of household with one child, the credit is completely phased out when AGI

exceeds $146,500. A qualifying child for

purposes of this credit follows the same requirements as the Child Tax Credit.

If an individual can be claimed as a dependent by someone else, they will not

qualify for the credit.

IRS will refund the credit as rapidly as

possible. If an individual hasn't yet filed a 2019 income tax return, IRS will

determine the amount of the rebate using information from the taxpayer's 2018

return. If no 2018 return has been filed, IRS will use information from the

individual's 2019 Form SSA-1099, Social Security Benefit Statement, or Form

RRB-1099, Social Security Equivalent Benefit Statement. IRS may make the rebate electronically to any

account to which the payee authorized, on or after Jan. 1, 2018, the delivery

of a refund of federal taxes or of a federal payment.

No

later than 15 days after distributing a rebate payment, IRS must mail a notice

to the taxpayer's last known address indicating how the payment was made, the

amount of the payment, and a phone number for reporting any failure to receive

the payment to IRS.

If,

when taxpayers file their 2020 income tax returns in 2021, they find that the

advanced credit is greater than the actual credit, then it appears that they

would not be required to repay the excess credit. In contrast, if the advanced

credit is less than the actual credit, then taxpayers would be able to claim

the difference on their 2020 income tax returns.

No 10% additional tax for

coronavirus-related retirement plan distributions up to $100,000

Distributions taken in 2020 qualify if

the individual is an individual (1) who is diagnosed with the virus SARS-CoV-2

or with coronavirus disease 2019 (COVID-19) by a test approved by the Centers

for Disease Control and Prevention (CDC), (2) whose spouse or dependent is

diagnosed with such virus or disease by such a test, or (3) who experiences

adverse financial consequences as a result of being quarantined, being

furloughed or laid off or having work hours reduced due to such virus or

disease, being unable to work due to lack of child care due to such virus or

disease, closing or reducing hours of a business owned or operated by the

individual due to such virus or disease, or other factors as determined by the

Secretary of the Treasury.

Any individual who receives a

coronavirus-related distribution may, at any time during the 3-year period

beginning on the day after the date on which such distribution was received,

make one or more contributions in an aggregate amount not to exceed the amount

of such distribution to an eligible retirement plan of which such individual is

a beneficiary and to which a rollover contribution of such distribution could

be made.

Unless the taxpayer elects not to, any

amount required to be included in gross income for such tax year will be so

included ratably over the 3-tax year period beginning with such tax year.

$300 above-the-line charitable

deduction

The CARES Act adds a deduction, in the

case of tax years beginning in 2020, for the amount (not to exceed $300) of

charitable contributions made by an individual that doesn’t itemize.

Tax-excluded education payments by an

employer temporarily include student loan repayments

An employee's gross income doesn't

include up to $5,250 per year of employer payments made under an educational

assistance program for the employee's education. The CARES Act adds to the types of

educational payments that are excluded from employee gross income

"eligible student loan repayments" made before January 1, 2021.

RMD requirement waived for 2020

The

CARES Act provides that required

minimum distributions (RMDs) do not apply for

calendar year 2020.

Additional Resources

The

Department of Labor’s explanation of who is covered by the Employer Paid Leave

Act does not, in our opinion, coincide with the likely intensions of

Congress. The businesses and employees

that were directly impacted by State officials’ quarantine orders beginning the

week of March 15th are not covered by the Act because the DOL made

the effective date for all rules to be April 1.

Even then, businesses that close as a result of quarantine orders are

not covered by the Act, according to DOL Q&A responses (as of March 28,

2020).

- It is currently unclear if employees who

are unable to work due to a business closure by a state governor will

receive paid sick leave.

- Pay requirements based on reason for

absence (see flow chart above)

- 100% pay up to $511/day; $5,110 in the

aggregate (immediate health concerns)

- 2/3 pay up to $200/day; $2,000 in the

aggregate (to care for others who are sick or cannot attend school/day

care)

- Pay is the greater of normal hourly rate,

federal minimum wage, or state minimum wage

- Pay is immediate – employees are not

required to use other accrued time off first

- Variable hour employees will receive the

equivalent pay for the average hours they would work per day over the

prior 6-month period.

- 2/3 regular pay up to $200/day; $10,000 in

the aggregate (10 weeks of pay, following the initial 2 weeks of leave)

- Timing of pay

- The first 10 days for which an employee

takes leave may consist of unpaid leave (however, see the previous flow

chart for the Emergency Paid Sick Leave Act – they should receive pay for

those first 10 days under that act).

- An employee may elect to substitute any

accrued vacation leave, personal leave, or medical or sick leave for

unpaid leave. (This should not be needed since they should receive 10

days under the first act.)

- Employer must provide paid leave for each

day of leave after the first 10 days

- Variable hour employees will receive the

equivalent pay for the average hours they would work per day over the

prior 6-month period.

Business

Guide for COVID-19 Issues

Employer

Posters to Display

https://www.dol.gov/sites/dolgov/files/WHD/posters/FFCRA_Poster_WH1422_Non-Federal.pdf

Department

of Labor Q&A

https://www.dol.gov/agencies/whd/pandemic/ffcra-questions

Conducting

Layoffs and Furloughs Resulting From Covid-19

https://www.vedderprice.com/new-updates-conducting-layoffs-and-furloughs-resulting-from-covid-19-business-impact

Employer Paid Leave

Requirements

https://www.dol.gov/agencies/whd/pandemic/ffcra-employer-paid-leave

Filing

For Unemployment

https://www.dol.gov/general/topic/unemployment-insurance

Illinois

Unemployment Process

https://www2.illinois.gov/ides/IDES%20Forms%20and%20Publications/BPP001F.pdf

Illinois

Unemployment Q&A

https://www2.illinois.gov/ides/Pages/COVID-19-and-Unemployment-Benefits.aspx

Indiana Department of

Workforce Development’s COVID-19 Information

https://www.in.gov/dwd/19.htm

Indiana Unemployment

COVID-19 FAQ

https://www.in.gov/dwd/files/Indiana_Unemployment_FAQ_Employers.pdf

Indiana Unemployment

Information

https://www.in.gov/dwd/3474.htm

Illinois

Small Business Grant and Loan Programs

https://www2.illinois.gov/dceo/SmallBizAssistance/Pages/EmergencySBAIntiatives.aspx

Indiana Small Business

Information

https://www.iedc.in.gov/response

Sales Tax

Waiver for Bars and Restaurants

https://www2.illinois.gov/rev/research/publications/bulletins/Documents/2020/FY2020-23.pdf

SBA

Guidance and Loan Resources

https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

Illinois

Essential Businesses

https://www2.illinois.gov/dceo/SmallBizAssistance/Documents/Essential%20Business%20Checklist3-22.pdf

Indiana Essential Businesses

https://coronavirus.in.gov/2496.htm

Other Links

Illinois

Coronavirus Website

https://coronavirus.illinois.gov/s/

Indiana

Coronavirus Website

https://coronavirus.in.gov/

Internal

Revenue Service Coronavirus Tax Relief

https://www.irs.gov/coronavirus

Illinois

Department of Revenue COVID-19 (Coronavirus) Information

https://www2.illinois.gov/rev/Pages/Taxpayer-Resources-during-COVID-19-%28Coronavirus%29-Outbreak.aspx

Copyright © 2020 Larsson, Woodyard & Henson, LLP